12.6 Niche Differentiation - Practice Round 1

Practice Round 1

Follow the decisions below. After the practice rounds are complete and the competition rounds begin, you are free to choose a different strategy; you are not obligated to continue as a Niche Differentiator.

R & D Round 1

Fast - Tweak positioning to reduce age. Reduce reliability (MTBF) to reduce material cost. Example: Increase Performance by 0.1 and reduce MTBF by 1000 hours.

Feat - Leave positioning alone, allowing the product to age further. Reduce reliability (MTBF) to reduce material cost. Example: reduce MTBF by 1000 hours.

Fist - Improve positioning and reduce age. Hold reliability (MTBF) steady. Example: Increase Fist's performance by 1.1 and decrease size by 1.1.

Foam - Improve positioning and reduce age. Improve reliability (MTBF) to enhance demand. Example: Increase Foam's performance by 1.4, decrease size by 0.5, and increase MTBF by 1000 hours.

Fume - Improve positioning and reduce age. Hold reliability (MTBF) steady. Example: Increase Fume's performance by 0.5 and decrease size by 1.4.

New High End Product - Launch a new High End product, with a project length of 20 to 23 months (no later than December of next year.) Example: Name: Fire (replace the first NA in the list), positioned at leading edge of High End segment, say Performance 10.2, Size 9.8. Set MTBF in the middle of the High End reliability (MTBF) range: MTBF 23000.

Important: Under the rules of the simulation, the names of all new products must have the same first letter as the name of the company.

Important: With the exception of the new product, make certain that the projects complete during this year before December 31st. Under the rules, a new project can only begin on January 1st. If these projects do not complete before the end of this year, you cannot begin follow-up projects next year.

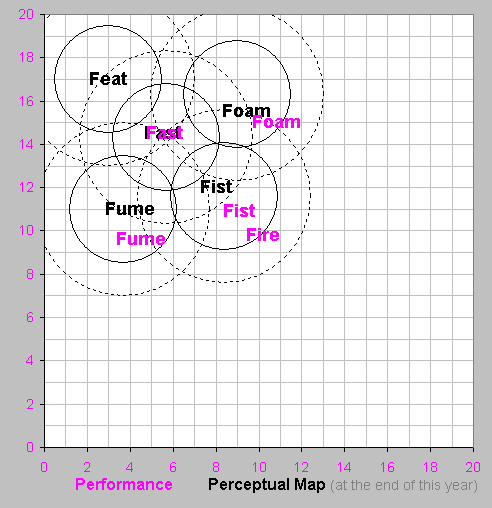

Perceptual Map from the Research & Development Spreadsheet: Product names in black indicate the product's current location, names in magenta indicate the product's revised position (with slight revisions, the names will overlap). Names of newly invented products appear in magenta.

Marketing Round 1

Fast - Increase price, make cuts in promotion and sales budget. Forecast unit sales near last year's level. Example: Price $28.50, promotion budget $600, sales budget $600, and sales forecast 1100.

Feat - Increase price, make cuts in promotion and sales budget. Forecast a decrease in unit sales from last year due to the price increase and decrease in promotion and sales. Example: Price $23.50, promotion budget $600, sales budget $600, and sales forecast 1400.

Fist - Increase price, promotion budget and sales budget. Forecast an increase in unit sales over year. Example: Price $39.50, promotion budget $2000, sales budget $2000, sales forecast 400.

Foam - Increase price, promotion budget and sales budget. Forecast an increase in unit sales over year. Example: Price $34.50, promotion budget $2000, sales budget $2000, sales forecast 490.

Fume - Increase price, promotion budget and sales budget. Forecast an increase in unit sales over year. Example: Price $34.50, promotion budget $2000, sales budget $2000, sales forecast 440.

New High End Product - No change required because the product will not emerge from R&D until next year.

Production Round 1

Production schedules will plan for eight weeks of inventory. That is, have enough inventory on hand to meet demand eight weeks beyond the sales forecast. This requires a 15% inventory cushion (8/52 = 0.15). For example, suppose Marketing forecasts demand at 1000, and you have 100 units in inventory. You want 1000 x 115% = 1150 available for sale. Since you have 100 on hand, you would schedule 1050 for production.

If you cannot meet demand, sales go to competitors. Therefore, you want to plan for the upside as well as the downside. Your proforma balance sheet will forecast about eight weeks of inventory. You hope that your actual sales will fall between your sales forecast and the number of units available for sale.

For each product, schedule production using the formula:

(Unit Sales Forecast X 1.15) - Inventory On Hand.

Fist - Sell 200 to 300 units of capacity. Fist has too much capacity, and given our new product it is unlikely that we will need 900 units of capacity in the future.

Make no other plant improvements to capacity or automation at this time.

Finance Round 1

Your fiscal policies should maintain adequate working capital reserves to avoid a liquidity crisis. Working capital can be thought of as the money that you need to operate day-to-day. In Capstone® working capital is current assets (cash + accounts receivable + inventory) - current liabilities (accounts payable + current debt). If you run out of cash because your sales are unexpectedly weak, an Emergency Loan will be issued.

Here are some guidelines to help you avoid an Emergency Loan . Your proforma balance sheet predicts your financial condition at the end of this year. Make conservative sales forecasts. Do not rely on the computer prediction. Override it with a forecast of your own. If you are conservative, it is unlikely that your worst expectations will be exceeded. Next, build additional inventory beyond your conservative expectations. This forces your proforma balance sheet to predict a future where your sales forecast comes true and you are left with inventory. (If you sell the inventory, that's wonderful.) On the Finance spreadsheet, issue stock, bonds or current debt until the December 31 Cash Position for the upcoming year equals at least five percent of your assets, as displayed on the proforma balance sheet. This creates an additional reserve for those times when your worst expectations are exceeded and disaster strikes.

As you gain experience with managing your working capital, you will observe that the guidelines above make you somewhat "liquid," and you may wish to tighten your policy by reducing cash and inventory projections. That is fine. The better your marketing forecasts, the less working capital you will require.

Pay a dividend between $0.75 and $1.25.

Do not issue current debt. If you are short of cash issue stock.

Save decisions (select "directly to the website").