12.4 Broad Differentiation - Practice Round 2

Practice Round 2

R & D Round 2

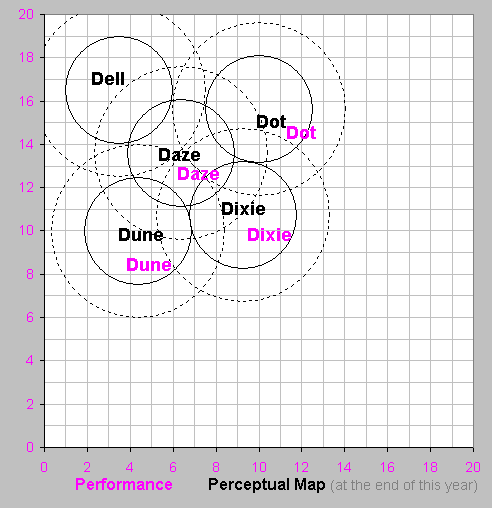

Daze - Improve positioning and reduce age. Hold reliability (MTBF) steady. Example: Increase Daze ' s performance by 0.9 and reduce size by 0.9.

Dell - Leave positioning alone, allowing the product to age further. Hold reliability (MTBF) steady. Example: No change required.

Dixie - Improve positioning and reduce age. Hold reliability (MTBF) steady. Example: Increase Dixie 's performance by 1.2 and reduce size by 1.2.

Dot - Improve positioning and reduce age. Improve reliability (MTBF) to enhance demand. Example: Increase Dot's performance by 1.4, reduce size by 0.5, and increase MTBF by 1000 hours.

Dune - Improve positioning and reduce age. Hold reliability (MTBF) steady. Example: Increase Dune' s performance by 0.4 and reduce size by 1.4.

Marketing Round 2

Daze - Hold price high, increase promotion and sales budget. Forecast sales as an improvement from last year. Example: Price $29.00, promotion budget $2200, sales budget $2200, and sales forecast 1500.

Dell - Hold price high, increase promotion and sales budget. Forecast moderate unit sales growth. Example: Price $23.50, promotion budget $2200, sales budget $2200, and sales forecast 1700.

Dixie - Hold price high, increase promotion and sales budget. Forecast unit sales near last year's level. Example: Price $39.00, promotion budget $2000, sales budget $2000, sales forecast 420.

Dot - Hold price high, increase promotion and sales budget. Forecast improved unit sales. Example: Price $34.00, promotion budget $1800, sales budget $1800, sales forecast 500.

Dune - Hold price high, increase promotion and sales budget. Forecast improved unit sales. Example: Price $34.00, promotion budget $1800, sales budget $1800, sales forecast 450.

Production Round 2

For each product, schedule production using the formula:

(Unit Sales Forecast X 1.15) - Inventory On Hand

Make no improvements to capacity or automation at this time.

Finance Round 2

Look at the proforma balance sheet, and add together your cash and inventory accounts. Apply the following rule of thumb. Keep between 15% and 20% of your balance sheet assets in cash plus inventory. You do not care about the mix, but you do want to have adequate reserves to cover unexpected swings in inventory.

Adjust your cash position to meet the guideline from Round 1. If you are cash poor, issue additional stock or additional bonds. If you are cash rich, pay dividends.

Do not issue current debt.

Save decisions (select "directly to the website").