12.3 Niche Cost Leader (Low Technology)

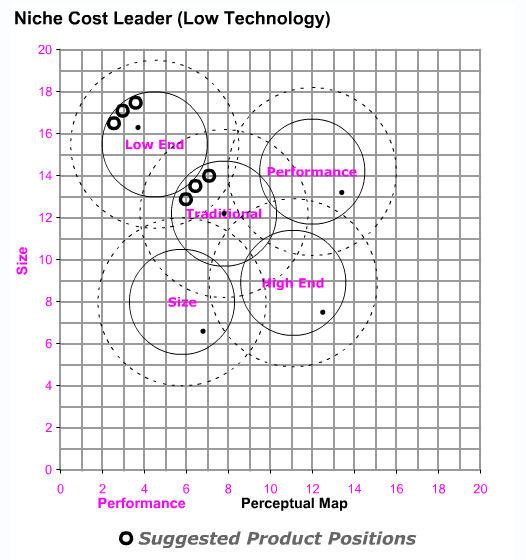

A Niche Cost Leader Strategy concentrates primarily on the Traditional and Low End segments of the market. The company will gain a competitive advantage by keeping R&D, production and material costs to a minimum, enabling the company to compete on the basis of price, which will be below average. Automation levels will be increased to improve margins and to offset second shift/overtime costs.

Mission Statement

Reliable products for low technology customers: Our brands offer value. Our stakeholders are bondholders, stockholders, customers and management.

Tactics

Research & Development: We will concentrate our existing product line into the Low End and Traditional segments. The traditional product will migrate to the Low End segment. The High product will migrate to the Traditional segment. During the early years we will migrate (gradually) our Performance and Size segment products to the Traditional segment. We can also introduce a new product to work in the Traditional market.

Marketing: Initially we will attempt to keep pace with the awareness and accessibility of our competitors' products. After we establish our cost leadership position we will revisit our situation to decide whether sales and promotion budgets should be reduced or if we should continue to match our competitors. Our prices will be lower than average.

Production: We will significantly increase automation levels on our products. However, because automation sets limits upon our ability to reposition products with R&D, we will postpone automation for the High End and Size products until they arrive in the Traditional Segment. We will prefer second shift/overtime to capacity expansions.

Finance: We will Finance our investments primarily through long-term bond issues, supplementing with stock offerings on an as needed basis. When our cash position allows, we will establish a dividend policy and begin to retire stock. We are not adverse to leverage, and expect to keep assets/equity between 2.0 and 3.0.

12 Six Basic Strategies

12 Six Basic Strategies