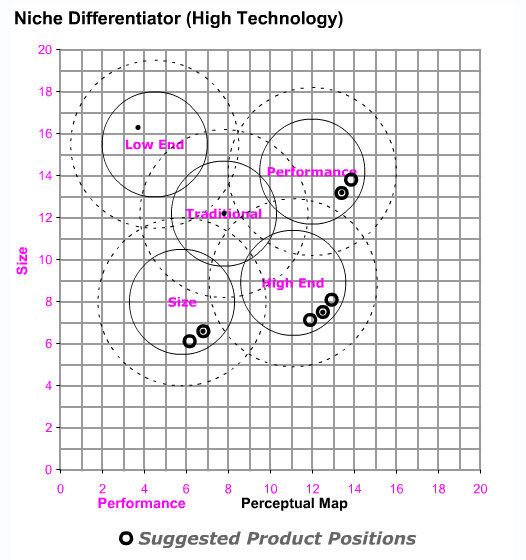

12.4 Niche Differentiator (High Technology)

A Niche Differentiator strategy focuses on the high technology segments (High End, Performance and Size). The company will gain a competitive advantage by distinguishing its products with an excellent design, high awareness, easy accessibility and new products. The company will develop an R&D competency that keeps designs fresh and exciting. Products will keep pace with the market, offering improved size and performance. The company will price above average, and will expand capacity as it generates higher demand.

Mission Statement

Premium products for technology oriented customers: Our brands define the cutting edge. Our stakeholders are customers, stockholders, management and employees.

Tactics

Research & Development: We will keep our existing technology products (High, Size & Performance), phase out Low End & Traditional, and introduce new technology product extenders in the High End, Performance and Size segments. Our goal is to offer technology oriented customers products that match their ideal criteria for positioning, age, and reliability.

Marketing: Our Company will spend aggressively in promotion and sales in the technology segments. We want every customer to know about our superb designs, and we want to make our products easy for customers to find. We will price at a premium. In the low technology segments we will exit gracefully, harvesting our products as they exit the Low End segment.

Production: We will grow capacity to meet the demand that we generate. After our products are well positioned, we will investigate modest increases in automation levels to improve margins, but never at the expense of our ability to reposition products and keep up with the high technology segments as they move across the perceptual map.

Finance: We will Finance our investments primarily through stock issues and cash from operations, supplementing with bond offerings on an as needed basis. When our cash position allows, we will establish a dividend policy and begin to retire stock. We are somewhat adverse to debt, and prefer to avoid interest payments. We expect to keep assets/equity (leverage) between 1.5 and 2.0.

12 Six Basic Strategies

12 Six Basic Strategies