Trade-Offs

Regarding the trade-offs with other performance measures, we are modestly increasing assets, using a hefty increase in equity and reduction in debt. Profits are good, but not quite as good as with a pure emphasis on cumulative profit. Dividends are zero. Stock is diluted.

The implications for other performance measures include:

- ROE: Falls because of increased equity.

- Asset turnover: Flat or improves somewhat.

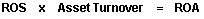

- ROA: Improves:

, therefore if ROS improves and asset turnover stays flat (worst case) , then ROA must improve.

, therefore if ROS improves and asset turnover stays flat (worst case) , then ROA must improve. - Stock price: Flat. Gains in book value are offset by stock dilution and zero dividends.

- Market cap: Increases. More shares at the original price.

- Cumulative profit: Increases.

- Market share: Flat. Gains in segments are offset by abandoning other segments.

In a basic sense, ROS forces management to emphasize efficiency. Related measures like ROA and cumulative profit improve in concert.

A board of directors would never impose ROS alone, although the overall affect is healthy upon the company. Used alone it has two important downsides. First, stockholders will be disappointed. Although market cap goes up, it is not because stock price improved, but because additional stockholders were added. Second, the company becomes a takeover target. It has such an attractive mix of debt and equity that a corporate raider could buy the company using its own debt capacity.

Return On Sales

Return On Sales