Trade-Offs

Regarding the trade-offs with other performance measures, we are reducing assets slightly (at a minimum, sharply limiting asset growth) . Profits are zero. Dividends are zero. Stock and bond issues are avoided. As depreciation accumulates, we pay down debt.The implications for other performance measures include: 1) ROE: Falls to zero. 2) ROS: Falls to zero. 3) ROA: Falls to zero.4) Stock price: Falls. 5) Market cap: Falls. 6) Cumulative profit: Falls. 7) Market share: Increases. It is easy to see that when used alone, emphasizing asset turnover is destructive. A board of directors would never impose it alone, but when teamed with a profit oriented measure, it is an important indicator of company health. For example, asset turnover multiplied by return on sales determines return on assets: This is the same equation using the defining ratios:

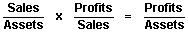

This is the same equation using the defining ratios:

Asset Turnover

Asset Turnover