Return on equity (ROE) is defined as .

.

ROE is an exceptionally popular measure with publicly held companies. It answers the question, “what rate of return is the company producing for its owners?”

The difference between ROA and ROE is the use of debt, also called leverage. Leverage is defined as  .

.

Put this way, leverage asks, “How many dollars of assets do we have for every dollar of equity?” If the answer is 2.15, then for every $1.00 of equity, we have $2.15 of assets, and therefore the remaining $1.15 must be in some form of debt.

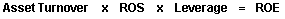

Owners note that ROE can also be defined as

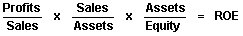

This is the same equation using the defining ratios:

These ratios address overlapping and vital questions. Asset turnover asks, “How hard are we working our assets to produce sales?”

Return On Equity

Return On Equity