This practice exercise will help you understand the relationships between business strategy, tactics, functional alignment, and the Capstone® simulation. We will use the Baldwin Company for this example. (During the practice rounds, each company is assigned a different strategy.)

Printable PDF Version for Distribution to Participants

You will execute your plan by inputting the decisions described below. At the same time, your competitors will execute their assigned plans. The practice exercise will take three rounds As each round is processed, you will evaluate the results and then input the next round's assigned decisions.

Upon completion of the practice rounds, the simulation will be reset to the beginning. You can then create and implement your own strategic plan for the actual competition.

We will adopt a Differentiation Strategy with a Product Lifecycle Focus, concentrating on the High End, Traditional, and Low End segments. We will gain a competitive advantage by distinguishing our products with an excellent design, high awareness, easy accessibility, and new products. We will develop an R&D competency that keeps our designs fresh and exciting. Our products will keep pace with the market, offering improved size and performance. We will price above average. We will expand capacity as we generate higher demand.

Premium products for mainstream customers: Baldwin brands withstand the tests of time. Our primary stakeholders are customers, stockholders, management, and employees.

We will reposition our Size and Performance segment products (Buddy and Bold) to the Traditional segment. We will allow our present Traditional segment product to become a Low End segment product as the segments drift. We will eventually introduce a new product to the High segment and will ultimately have at least two products each in the High, Traditional, and Low End segments. Our goal is to offer customers products that match their ideal criteria for positioning, age, and reliability.

We will spend aggressively in promotion and sales in our targeted segments (High, Traditional, and Low). We want every customer to know about our superb designs, and we want to make our products easy for customers to find. We will price at a premium.

We will grow capacity to meet the demand that we generate, avoiding a second shift when possible. After our products are well positioned, we will investigate moderate increases in automation levels to improve margins, but never at the expense of our ability to reposition products and keep up with segments as they move across the perceptual map (higher automation levels increase the time required for R&D projects to complete).

We will finance our investments primarily through stock issues and retained earnings, supplementing with bond offerings on an as needed basis. When our cash position allows, we will establish a dividend policy and begin to retire stock. We are somewhat adverse to debt, and prefer to avoid interest payments. We expect to keep assets/equity (Leverage ) between 1.5 and 2.0.

Follow the decisions below. After the practice rounds are complete and the competition rounds begin, you are free to choose a different strategy; you are not obligated to continue as a Product Lifecycle Differentiator.

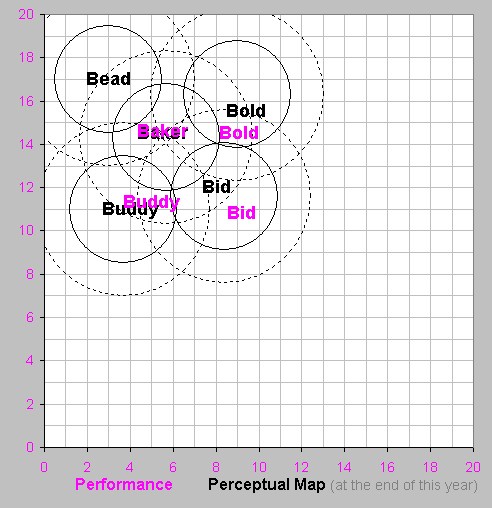

Baker - Tweak positioning to reduce age. Leave reliability (MTBF) unchanged. Example: Increase Baker's size by 0.1. Baker will eventually become a Low End product.

Bead - No changes. The customer wants an older product that trails the segment.

Bid - Improve positioning and reduce age. Leave reliability (MTBF) unchanged. Example: Increase Bid's performance by 1.2 and reduce size by 1.2.

Bold - Begin migration towards Traditional segment. Leave reliability (MTBF) unchanged. Example: Reduce Bold's performance by 0.3 and reduce size by 1.0.

Buddy - Begin migration to Traditional segment. Leave reliability (MTBF) unchanged. Example: Increase Buddy's performance by 1.0 and increase size by 0.3.

Important: Make certain that the projects complete during this year before December 31st. Under the rules, a new project can only begin on January 1st. If these projects do not complete before the end of this year, you cannot begin follow-up projects next year.

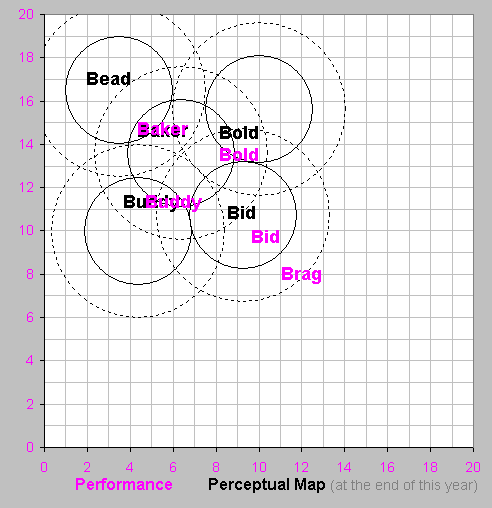

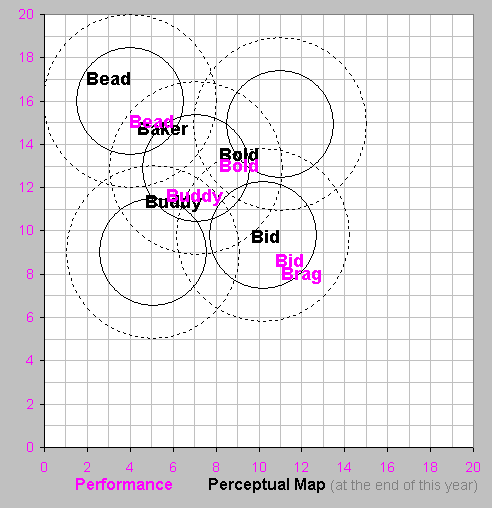

Perceptual Map from the Research & Development Spreadsheet: Product names in black indicate the product's current location, names in magenta indicate the product's revised position (with slight revisions, the names will overlap). Names of newly invented products appear in magenta.

Baker - Significantly increase promotion and sales budgets. Implement a moderate price increase. Forecast improved unit sales, driven by an improved design and marketing expenditures. Example: Price $28.50, promotion budget $1500, sales budget $1800, and sales forecast 1700.

Bead - Increase price, increase promotion and sales budgets. Forecast improved unit sales. Example: Price $22.00, promotion budget $1500, sales budget $1800, and sales forecast 1800.

Bid - Increase price, increase promotion and sales budget. Forecast unit sales near last year's level. Example: Price $39.50, promotion budget $1500, sales budget $1500, sales forecast 400.

Bold - Increase price, increase promotion budget, but decrease sales budget. The sales budget drives distribution systems in the Performance Segment, and we are leaving the segment. Forecast unit sales near last year's level. Example: Price $34.50, promotion budget $1500, sales budget $300, sales forecast 400.

Buddy - Increase price, increase promotion budget, but decrease sales budget. Forecast unit sales near last year's level. Example: Price $34.50, promotion budget $1500, sales budget $300, sales forecast 370.

Production schedules will plan for eight weeks of inventory. That is, have enough inventory on hand to meet demand eight weeks beyond the sales forecast. This requires a 15% inventory cushion (8/52 = 0.15). For example, suppose Marketing forecasts demand at 1000, and you have 100 units in inventory. You want 1000 x 115% = 1150 available for sale. Since you have 100 on hand, you would schedule 1050 for production.

If you cannot meet demand, sales go to competitors. Therefore, you want to plan for the upside as well as the downside. Your proforma balance sheet will forecast about eight weeks of inventory. You hope that your actual sales will fall between your sales forecast and the number of units available for sale.

For each product, schedule production using the formula:

(Unit Sales Forecast X 1.15) - Inventory On Hand.

Make no improvements to capacity or automation at this time.

Your fiscal policies should maintain adequate working capital reserves to avoid a liquidity crisis. Working capital can be thought of as the money that you need to operate day-to-day. In Capstone® working capital is current assets (cash + accounts receivable + inventory) - current liabilities (accounts payable + current debt). If you run out of cash because your sales are unexpectedly weak, an Emergency Loan will be issued.

Here are some guidelines to help you avoid an Emergency Loan . Your proforma balance sheet predicts your financial condition at the end of this year. Make conservative sales forecasts. Do not rely on the computer prediction. Override it with a forecast of your own. If you are conservative, it is unlikely that your worst expectations will be exceeded. Next, build additional inventory beyond your conservative expectations. This forces your proforma balance sheet to predict a future where your sales forecast comes true and you are left with inventory. (If you sell the inventory, that's wonderful.) On the Finance spreadsheet, issue stock, bonds or current debt until the December 31 Cash Position for the upcoming year equals at least five percent of your assets, as displayed on the proforma balance sheet. This creates an additional reserve for those times when your worst expectations are exceeded and disaster strikes.

As you gain experience with managing your working capital, you will observe that the guidelines above make you somewhat "liquid," and you may wish to tighten your policy by reducing cash and inventory projections. That is fine. The better your marketing forecasts, the less working capital you will require.

Pay a dividend between $0.50 and $1.00.

Do not issue current debt. If you are short of cash issue stock.

Save decisions (select "directly to the website").

Baker - Tweak positioning to reduce age. Example: Increase Baker's Size by 0.1. Baker will soon become a Low End product, but it remains primarily a Traditional product for this year.

Bead - No changes. The customer wants an older product that trails the segment.

Bid - Improve positioning and reduce age. Leave reliability (MTBF) unchanged. Example: Increase Bid's performance by 1.1 and reduce size by 1.1.

Bold - Continue migration towards Traditional segment. Target Bold for the leading point where the Performance and Traditional circles intersect. Reduce reliability (MTBF) to the bottom of the Performance customer's acceptable range. Example: Reduce Bold's size by 1.0 and reduce MTBF by 2000 hours.

Buddy - Continue migration to Traditional segment. Target Buddy for the leading point where the Size and Traditional circles intersect. Reduce reliability (MTBF) to the bottom of the Size customer's acceptable range. Example: Increase Buddy's performance by 1.0, and decrease MTBF by 2000 hours.

New Product: Launch a new High End product, with a project length of 20 to 23 months (no later than December of next year.) Example: Name: Brag (replace the first NA in the list), positioned at the leading edge of High End segment, try a performance 12.0, a size of 8.0 and a minimum acceptable High End reliability (MTBF) of 23000.

Important: Under the rules of the simulation, the names of all new products must have the same first letter as the name of the company.

Baker - Increase promotion and sales budgets. Hold price. Forecast unit sales near last year's level. Example: Price $28.50, promotion budget $2000, sales budget $2200, and sales forecast 1500.

Bead - Hold price, increase promotion and sales budget. Forecast moderate unit sales growth from last year. Example: Price $22.00, promotion budget $2000, sales budget $2200, and sales forecast 1700.

Bid - Hold price, increase promotion and sales budget. Forecast slightly improved unit sales. Example: Price $38.50, promotion budget $2000, sales budget $2000, sales forecast 450.

Bold - Hold price, increase promotion budget, and hold sales budget steady. Forecast unit sales near last year's level. Example: Price $34.00, promotion budget $1800, sales budget $300, sales forecast 350.

Buddy - Hold price, increase promotion budget, and hold sales budget steady. Forecast unit sales near last year's level. Example: Price $34.00, promotion budget $1800, sales budget $300, sales forecast 320.

Continue to use the Production rule of thumb - plan for three months of inventory.

For each product, schedule production using the formula:

(Unit Sales Forecast X 1.15) - Inventory On Hand

Make no improvements to capacity or automation at this time for existing products.

For your new product, buy 600,000 units of capacity by entering 600 in the Buy Sell Capacity cell. Set an automation level of 4.0.

Important: There is a one year lag between purchase and use of new capacity and automation for both new and existing products.

Match your plant investment with a stock issue. If you cannot raise adequate capital to match the investment, issue bonds to cover the shortfall.

Look at the proforma balance sheet, and add together your cash and inventory accounts. Apply the following rule of thumb. Keep between 15% and 20% of your balance sheet assets in cash plus inventory. You do not care about the mix, but you do want to have adequate reserves to cover unexpected swings in inventory.

Adjust your cash position to meet the guideline from Round 1. If you are cash poor, issue additional stock or additional bonds. If you are cash rich, pay dividends.

Do not issue current debt.

Save decisions (select "directly to the website").

Baker - Do not change positioning age. Set reliability (MTBF) to the middle of the Low End customer's expectations. Baker will now become a Low End product.

Bead - Reposition Bead to the current leading edge of the Low End segment. This will take 1.5 to 2.0 years, and it will sacrifice both positioning and age. It is necessary, however, to keep Bead within the Low End segment in the long run. Example: Increase performance by 2.0 and reduce size by 2.0.

Bid - Improve positioning and reduce age. Leave reliability (MTBF) unchanged. Example: Increase Bid's performance by 1.1 and reduce size by 1.1.

Bold - Enter the Traditional segment. Reduce reliability (MTBF) to the middle of the Traditional customer's acceptable range. Example: Reduce Bold's size by 0.5, and reduce MTBF by 5000 hours.

Buddy - Enter the Traditional segment. Leave reliability (MTBF) in the middle of the Traditional customer's acceptable range. Example: Increase Buddy's performance by 1.0 and increase size by 0.3.

New Product - Note that the new product's row is yellow instead of green, and that you cannot change these cells. This is because your product will not emerge from R&D until its current project completes. Under the rules of the simulation, new R&D projects cannot begin until the old one completes.

Baker - Hold promotion and sales budgets. Drop price below $23.50, the top of the Low End price range. Baker is transitioning between the Low End and Traditional segments, slightly reduce sales forecast. Example: Price $23.00, promotion budget $2000, sales budget $2200, and sales forecast 1500.

Bead - Hold price, promotion and sales budgets. Forecast moderate unit sales growth from last year. Example: Price $22.00, promotion budget $2000, sales budget $2200, and sales forecast 2000.

Bid - Hold price, promotion and sales budgets. Forecast improved unit sales. Example: Price $38.50, promotion budget $2000, sales budget $2000, sales forecast 600.

Bold - Drop price below $28.50, the top of the Traditional range. Hold promotion budget, and increase sales budget significantly to pump up the Traditional distribution channels. Forecast a major increase in unit sales from last year. Example: Price $28.00, promotion budget $1800, sales budget $1800, sales forecast 1100.

Buddy - Drop price below $28.50. Hold promotion budget and increase sales budget. Forecast a major increase in unit sales from last year. Example: Price $28.00, promotion budget $1800, sales budget $1800, sales forecast 1200.

New Product - Price at the top of the High End segment. Enter promotion and sales budgets comparable to existing products. Example: Price $38.50, promotion budget $1800, sales budget $1800.

Important: New products begin production the day they emerge from R&D (Revision Date). Therefore, they cannot produce up to twice their first shift capacity in the year they are introduced. Therefore, no forecast is necessary. (Production should plan to build as many units as it can produce).

Production Round 3

Continue to use the Production rule of thumb - plan for three months of inventory.

For each existing product, schedule production using the formula:

(Unit Sales Forecast X 1.15) - Inventory On Hand

Important: As your new product is coming out sometime during the year, you might not be able to use the above formula - new products cannot begin production prior to their revision (release) date. Should the number you enter into the production schedule turn red, reduce the schedule until the red number turns black.

Increase capacity on Bold and Buddy. For example, buy 400,000 units of capacity for each by entering 400 in the Buy Sell Capacity cell.

You may be able to pay for your plant expansion with Cash on hand. If not, issue stock.

Look at the proforma balance sheet, and add together your Cash and Inventory accounts. Apply the following rule of thumb. Keep between 15% and 20% of your balance sheet assets in Cash plus Inventory. You do not care about the mix, but you do want to have adequate reserves to cover unexpected swings in inventory.

Adjust your cash position to meet the guideline from Round 1. If you are cash poor, issue additional stock or additional bonds. If you are cash rich, pay dividends.

Do not issue current debt.

Save decisions (select "directly to the website").

Your instructor might want you to play another practice round. If so, continue the Product Lifecycle Differentiation vision.

Having executed the plan for two or three rounds, you are now in a position to analyze it. Consider the following questions:

What are this plan's strengths? Weaknesses?

How will competitors respond to your actions?

How can you influence competitors to avoid competing with you directly?

Which performance measures support this plan?

What is the long range potential of this plan? Its future sales volume? Its future profitability?

How can you best coordinate this plan as a team?