The information reported in your Industry Conditions Report will help you understand your customers.

Your customers fall into different groups which are represented by market segments. A market segment is a group of customers that has similar needs. The segments are named for the customer’s primary requirements such as:

- Traditional

- Low End

- High End

- Performance

- Size

The Industry Conditions Report lists market segment sales percentages and projected growth rates unique to your simulation.

The Industry Conditions Report is available from the website. Log into your simulation then click the Reports link.

2.1 Buying Criteria

Customers within each market segment employ different standards as they evaluate products. They consider four buying criteria: Price, Age, MTBF (Mean Time Before Failure) and Positioning.

2.1.1 Price

Each segment has different price expectations. One segment might want inexpensive products while another, seeking advanced technology, might be willing to pay higher prices.

2.1.2 Age

Each segment has different age expectations, that is, the length of time since the product was invented or revised. One segment might want brand new technology while another might prefer proven technology that has been in the market for a few years.

2.1.3 MTBF (Mean Time Before Failure) or Reliability

MTBF (Mean Time Before Failure) is a rating of reliability measured in hours. Segments have different MTBF criteria. Some might prefer higher MTBF ratings while others are satisfied with lower ratings.

2.1.4 Positioning

Sensors vary in their dimensions (size) and the speed/sensitivity with which they respond to changes in physical conditions (performance). Combining size and performance creates a product attribute called positioning.

The Perceptual Map

Positioning is such an important concept that marketers developed a tool to track the position of their products and those of their competitors. This tool is called a Perceptual Map.

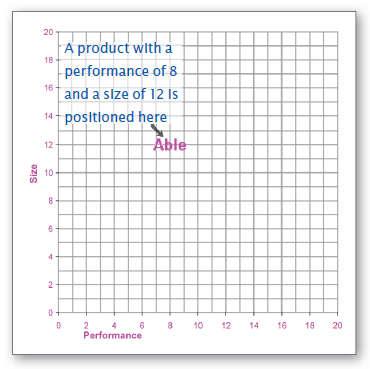

Note the Perceptual Map in Figure 2.1. You will see this map quite often through the course of the simulation.

The map measures size on the vertical axis and performance on the horizontal axis. Each axis extends from 0 to 20 units. The arrow in Figure 2.1 points to a product called Able with a performance measurement of 8.0 and a size of 12.0.

2.1.5 Market Segment Positions on the Perceptual Map

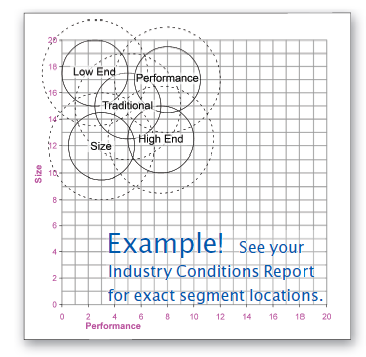

Customers within each market segment have different positioning preferences. For example, a segment might be satisfied with inexpensive products that are slow performing and large in size. That segment would want products that fall inside the upper left set of dashed and solid circles in Figure 2.2. A segment that wants products that are fast performing and small in size would want products that fall within the lower right set of dashed and solid circles.

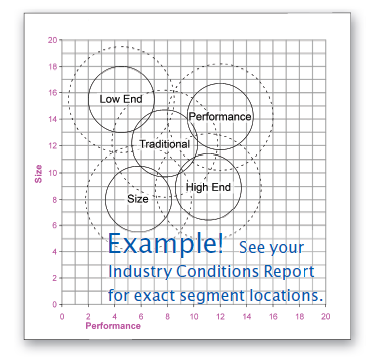

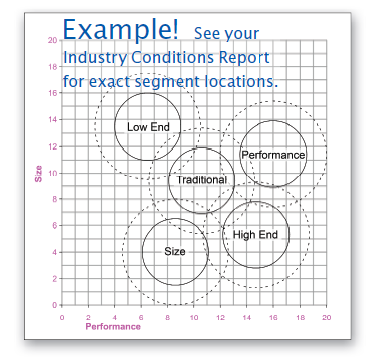

Over time, your customers expect products that are smaller and faster. This causes the segments to move or drift a little each month. As the years progress the locations of the circles significantly change. The example in Figure 2.3 shows the location of the market segments at the end of the fourth year. Figure 2.4 shows the segments at the end of the eighth year.

Each year, some market segments demand greater improvement than others. Therefore segments drift at different rates. Segments demanding greater improvement will move faster and farther than others. As time goes by, the overlap between the segments diminishes.

Drift rates are published in the Industry Conditions Report. This animation demonstrates segment drift over eight years. Your drift rates and segment positions might be different.

Market segments will not move faster to catch up with products that are better than customer expectations. Customers will refuse to buy a product positioned outside the circles. Customers are only interested in products that satisfy their needs. This includes being within the circles on the Perceptual Map!

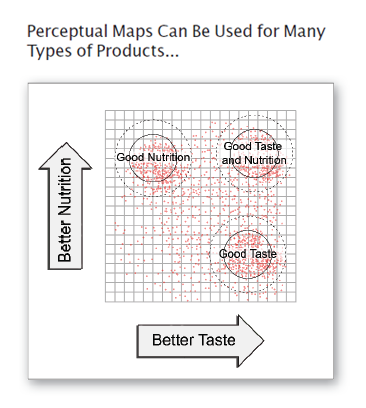

Perceptual Maps can be used to plot any two product characteristics. For example, cereal manufacturers could plot nutrition and taste. The dots in the figure below represent sales of breakfast cereals based on ratings of taste and nutrition. There are few sales in the lower left corner–not many consumers want products that have poor taste and poor nutrition.

As they review product sales, marketers would notice three distinct clusters. The cluster to the upper left indicates a group of customers that is more interested in nutrition than taste. The cluster to the lower right indicates a group that is more interested in taste than nutrition. The cluster to the upper right indicates a group that wants both good taste and good nutrition.

The clusters, or market segments, could then be named “Taste,” “Nutrition” and “Taste/Nutrition.” The simulation uses a similar positioning method to name its market segments.

Your R&D and Marketing Departments have to make sure your products keep up with changing customer preferences. To do this, R&D must reposition products, keeping them within the moving segment circles. See “4.1 Research & Development (R&D)” for more information.

2.2 Buying Criteria by Segment

Buyers in each segment place a different emphasis upon the four buying criteria. For example, some customers are more interested in price, while others are more interested in positioning.

Positioning and price criteria change every year. Age and MTBF criteria always remain the same.

Buying Criteria for the previous year are reported in the Capstone Courier’s Segment Analysis pages. As you take over the company to make decisions for Round 1, your reports reflect customer expectations as of December 31, Round 0 (yesterday). The Industry Conditions Report displays the Round 0 buying criteria for each market segment. Here are two example segments.

Example 1 customers seek proven products at a modest price.

- Age, 2 years– importance: 47%

- Price, $20.00-$30.00– importance: 23%

- Ideal Position, performance 5.0 size 15.0– importance: 21%

- MTBF, 14,000-19,000– importance: 9%

Example 2 customers seek cutting-edge technology in size/performance and new designs.

- Ideal Position, performance 8.9 size 11.1– importance: 43%

- Age, 0 years– importance: 29%

- MTBF, 20,000-25,000– importance: 19%

- Price, $30.00-$40.00– importance: 9%