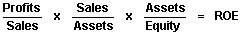

Return on equity (ROE) is defined as .

.

ROE is an exceptionally popular measure with publicly held companies. It answers the question, “what rate of return is the company producing for its owners?”

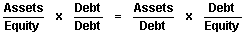

The difference between ROA and ROE is the use of debt, also called leverage. Leverage is defined as  .

.

Put this way, leverage asks, “How many dollars of assets do we have for every dollar of equity?” If the answer is 2.15, then for every $1.00 of equity, we have $2.15 of assets, and therefore the remaining $1.15 must be in some form of debt.

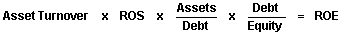

Owners note that ROE can also be defined as

This is the same equation using the defining ratios:

These ratios address overlapping and vital questions. Asset turnover asks, “How hard are we working our assets to produce sales?”

ROS Asks

ROS asks, “How hard are we working the income statement to produce a profit?

Multiplied together, ROS and asset turnover produce ROA, which asks, “How hard are we working the assets to produce a profit?”

Leverage is such an important idea that the various stakeholders—debt holders, equity holders, and management —prefer different formulas to define it. Note that:

If we plug this leverage definition into the ROE formula we see

Equity holders prefer  , “how much assets do we have for every dollar of equity?” Equity holders prefer bigger values, provided that the investments are good ones. Their reasoning goes, “management’s job is to identify high return investments. For example, if they find investments for my money that return 25%, they should invest my money, and they should borrow as much as they can at 10%, so that I get the other 15% on the lender’s money, too.”

, “how much assets do we have for every dollar of equity?” Equity holders prefer bigger values, provided that the investments are good ones. Their reasoning goes, “management’s job is to identify high return investments. For example, if they find investments for my money that return 25%, they should invest my money, and they should borrow as much as they can at 10%, so that I get the other 15% on the lender’s money, too.”

Debt holders prefer  , “how much assets do we have for every dollar of debt?” They also prefer bigger numbers. At $1 assets for every $1 of debt, or 1.0 the entire company is funded by debt. At 2.0, then there is a dollar of equity for every dollar of debt, and their risk falls. Their reasoning goes, “sure, I want to lend money, but there is a chance the company will fail. If so, we can sell the assets and recover our principal. Unfortunately, we will be lucky to get some fraction for each dollar of assets, say $.50 for each dollar of assets. In that case, we get the $.50, and the equity holder gets nothing.”

, “how much assets do we have for every dollar of debt?” They also prefer bigger numbers. At $1 assets for every $1 of debt, or 1.0 the entire company is funded by debt. At 2.0, then there is a dollar of equity for every dollar of debt, and their risk falls. Their reasoning goes, “sure, I want to lend money, but there is a chance the company will fail. If so, we can sell the assets and recover our principal. Unfortunately, we will be lucky to get some fraction for each dollar of assets, say $.50 for each dollar of assets. In that case, we get the $.50, and the equity holder gets nothing.”

Managers prefer  . At 1.0, there is a dollar of debt for every dollar of equity. At 2.0, there are two dollars of debt for every dollar of equity. Managers want to keep their jobs, and in that regard they face two risks. If the company cannot meet its interest obligations, debt holders can force the company into receivership and fire management. On the other hand, if a public company has little leverage, it becomes a takeover target.

. At 1.0, there is a dollar of debt for every dollar of equity. At 2.0, there are two dollars of debt for every dollar of equity. Managers want to keep their jobs, and in that regard they face two risks. If the company cannot meet its interest obligations, debt holders can force the company into receivership and fire management. On the other hand, if a public company has little leverage, it becomes a takeover target.

The key questions are, “who gets the wealth that is being created?”, and “who takes the risk of failure?”

Looking For Wealth

| INCOME STATEMENT | ||

| Sales | $160,000 | 100.0% |

| Variable Costs | $90,000 | 56.3% |

| Period Costs | $40,000 | 25.0% |

| EBIT | $30,000 | 18.8% |

| Interest | $4,000 | 2.5% |

| Tax | $9,100 | 5.7% |

| Profit | $16,900 | 10.6% |

| LIABILITIES & OWNER'S EQUITY | ||

| Accounts Payable | $9,380 | 7.0% |

| Current Debt | $12,060 | 9.0% |

| Long Term Debt | $58,960 | 44.0% |

| Total Liabilities | $80,400 | 60.0% |

| Common Stock | $21,038 | 15.7% |

| Retained Earnings | $32,562 | 24.3% |

| Total Equity | $53,600 | 40.0% |

| Total Liab. & O. E. | $134,000 | 100.0% |

| RATIOS | ||

| ROS | 10.6% | |

| Asset Turnover | 119.4% | |

| Leverage | ||

| Assets/Equity | 2.5 | |

| (OR Assets/Debt | 1.7 | |

| times Debt/Equity) | 1.5 | |

| ROE | 31.5% | |

Traditionally, wealth is found at the EBIT line on the income statement. Looking at the income statement we can see that the wealth is split between lenders (interest) , government (taxes) , and owners (profits).

However, managers capture wealth before the EBIT line in form or salaries, buried in period costs. In recent times this has become a major issue in strategy, expressed in two parts, executive compensation and management turnover. Although that discussion is far broader than we can discuss here, we can note that if the company is publicly held, management will seek moderate levels of leverage, neither too low (risk of take-over) nor too high (risk of bankruptcy) . In privately held companies, management will prefer ROA to ROE and reduce leverage to more modest levels.

Leverage Is Key

From this discussion we can see that leverage is the key issue in the financial structure of the firm. We can make a few generalizations for publicly held companies.

Using stockholder’s  as the definition, a leverage of 1.0 means the company is entirely funded by equity. Stockholders, including potential stockholders like a corporate raider, will ask, “Why can’t management borrow, invest the money, and make profits on the borrowed funds?” Management can expect trouble at a leverage of 1.0.

as the definition, a leverage of 1.0 means the company is entirely funded by equity. Stockholders, including potential stockholders like a corporate raider, will ask, “Why can’t management borrow, invest the money, and make profits on the borrowed funds?” Management can expect trouble at a leverage of 1.0.

At a leverage of 2.0, for every dollar of equity, there is a dollar of debt. Management and bankers will be happy, although stockholders might pressure for more debt.

At a leverage of 3.0, for every dollar of equity, there are two dollars of debt. If the investments are good, stockholders will be delighted. Management and debt holders will be modestly uncomfortable.

At a leverage of 4.0, for every dollar of equity, there are three dollars of debt. Even stockholders are likely to be uncomfortable. Management will feel pressure to bring down the leverage, and are at some risk of losing their jobs if they do not.

How would applying ROE alone likely affect the balance sheet?

Management will buy assets. The assets will produce higher sales volume. The higher sales volume will increase profits. Management will minimize stock issues, and they will pay dividends to get rid of any excess (non-leveraged) retained earnings.

Assets Minimally Increased To Emphasise Roe

| ASSETS | LIABILITIES & OWNER'S EQUITY | |||

| Cash | $4,000 | Accounts Payable | $9,380 | 7.0% |

| Accounts Receivable | $14,000 | Current Debt | $12,060 | 9.0% |

| Inventory | $18,000 | Long Term Debt | $58,960 | 44.0% |

| Total Current Assets | $36,000 | Total Liabilities | $80,400 | 60.0% |

| Plant and equipment | $150,000 | Common Stock | $21,038 | 15.7% |

| Accum. Depreciation | ($52,000) | Retained Earnings | $32,562 | 24.3% |

| Total Fixed Assets | $98,000 | Total Equity | $53,600 | 40.0% |

| Total Assets | $134,000 | Total Liab. & O. E. | $134,000 | 100.0% |

The implications for other performance measures include:

- ROS: Should at least stay flat, and probably improves.

- Asset turnover: Should at least stay flat, and probably improves.

- ROA: Should at least stay flat, and probably improves.

- Stock price: Increases. EPS increases. Excess working capital is returned to stockholders as dividends. There are few stock issues to dilute stock.

- Market cap: Increases as stock price goes up.

- Cumulative profit: Increases.

- Market share: Hard to predict. Often there is some tradeoff in the short run between profits and market share. Management is reluctant to reduce profits, but knows that increasing sales volume while holding ROS constant must increase asset turnover, and therefore improve ROA and ROE. At best, we see modest improvements in market share.

At a big picture level, assets are some multiple of equity. If equity is kept small, the asset base must be small. Therefore, in the long run, emphasis on ROE can stunt a company.