Your Finance Department is primarily concerned with five issues:

- Acquiring the capital needed to expand assets, particularly plant and equipment. The company has two outside sources of money (stock issues are not permitted):

- Current Debt

- Bond Issues ( Long Term Debt)

- Profits

- Establishing a dividend policy that maximizes the return to shareholders.

- Setting accounts payable policy (which is entered on the Production spreadsheet) and accounts receivable policy (which is entered on the Marketing spreadsheet) .

- Driving the financial structure of the firm and its relationship between debt and equity.

- Selecting and monitoring performance measures that support your strategy.

Finance decisions should be made after the other departments enter their decisions. After the management team decides what resources the company needs, the Finance Department addresses funding issues and financial structure.

One of the Finance Department's fiduciary duties is to verify that sales forecasts and prices are realistic. Unrealistic prices and forecasts will predict unrealistic cash flow. The department should challenge the Marketing managers to defend their forecasts and pricing decisions.

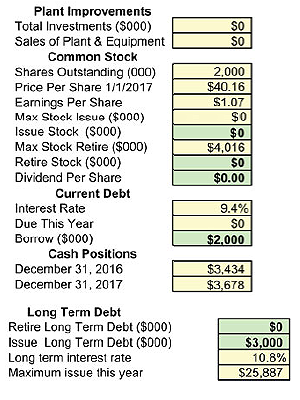

4.4.1 Current Debt

Your bank issues current debt in one year notes. The Finance area in the Capstone Spreadsheet displays the amount of current debt due from the previous year. The company can “roll” that debt by simply borrowing the same amount again. There are no brokerage fees for current debt. Interest rates are a function of your debt level. The more debt you have relative to your assets, the more risk you present to debt holders and the higher the current debt rates.

As a general rule, companies fund short term assets like accounts receivable and inventory with current debt offered by banks.

Bankers will loan current debt up to about 75% of your accounts receivable (found on last year's balance sheet) and 50% of this year's inventory. They estimate your inventory for the upcoming year by examining last year's income statement. Bankers assume your worst case scenario will leave a three to four month inventory, and they will loan you up to 50% of that amount. This works out to be about 15% of the combined value of last year's total direct labor and total direct material, which display on the income statement.

Because they know your industry is growing, as a final step bankers increase your borrowing limit by 20% to provide you with room for expansion in inventory and accounts receivable.

4.4.2 Bonds

All bonds are ten year notes. Your company pays a 5% brokerage fee for issuing bonds. The fi rst three digits of the bond, the series number, refl ect the interest rate. The last four digits indicate the year in which the bond is due. The numbers are separated by the letter S which stands for “series.” For example, a bond with the number 12.6S2014 has an interest rate of 12.6% and is due December 31, 2014.

As a general rule, bond issues are used to fund long term investments in capacity and automation.

Bondholders will lend total amounts up to 80% of the value of your plant and equipment (the Production Department’s capacity and automation). Each bond issue pays a coupon, the annual interest payment, to investors. If the face amount or principal of bond 12.6S2014 were $1,000,000, then the holder of the bond would receive a payment of $126,000 every year for ten years. The holder would also receive the $1,000,000 principal at the end of the tenth year. Each year your company is given a credit rating that ranges from AAA (best) to D (worst). In Capstone, ratings are evaluated by comparing current debt interest rates with the prime rate.

When issuing new bonds, the interest rate will be 1.4% over the current debt interest rates. If your current debt interest rate were 12.1%, then the bond rate would be 13.5%.

You can buy back outstanding bonds before their due date. A 1.5% brokerage fee applies. These bonds are repurchased at their market value or street price on January 1 of the current year. The street price is determined by the amount of interest the bond pays and your credit worthiness. It is therefore different from the face amount of the bond. If you buy back bonds with a street price that is less than its face amount, you make a gain on the repurchase. This will be reflected as a negative write-off on the income statement (see 6.3 Income Statement).

Bonds are retired in the order they were issued. The oldest bonds retire first. There are no brokerage fees for bonds that are allowed to mature to their due date.

If a bond remains on December 31 of the year it becomes due, your banker lends you current debt to pay off the bond principal. This, in effect, converts the bond to current debt. This amount is combined with any other current debt due at the beginning of the next year.

When Bonds Are Retired Early: A bond with a face amount of $10,000,000 could cost $11,000,000 to repurchase because of fl uctuations in interest rates and your credit worthiness. A 1.5% brokerage fee applies. The difference between the face value and the repurchase price will refl ect as a gain or loss in the income statement’s fees and write-offs.

When Bonds Come Due: Assume the face amount of bond 12.6S2014 is $1,000,000. The $1,000,000 repayment is acknowledged in your reports and spreadsheets in the following manner: Your annual reports from December 31, 2014 would refl ect an increase in current debt of $1,000,000 offset by a decrease in long term debt of $1,000,000. The 2014 spreadsheet will list the bond because you are making decisions on January 1, 2014, when the bond still exists. Your 2015 spreadsheet would show a $1,000,000 increase in current debt and the bond no longer appears.

Bond Ratings: If your company has no debt at all, your company is awarded a AAA bond rating. As your debt-toassets ratio increases, your current debt interest rates increase. Your bond rating slips one category for each additional 0.5% in current debt interest. For example, if the prime rate is 10%, and your current debt interest rate is 10.5%, then you would be given a AA bond rating instead of a AAA rating.

4.4.3 Stock

Stock issue transactions take place at the current market price. Your company pays a 5% brokerage fee for issuing stock. New stock issues are limited to 20% of your company's outstanding shares in that year.

Stock price is driven by book value, the last two years' earnings per share (EPS) and the last two years' annual dividend.

Book value is equity divided by shares outstanding. Equity equals the common stock and retained earnings values listed on the balance sheet. Shares outstanding is the number of shares that have been issued. For example, if equity is $50,000,000 and there are 2,000,000 shares outstanding, book value is $25.00 per share.

EPS is calculated by dividing net profit by shares outstanding.

The dividend is the amount of money paid per share to stockholders each year. Stockholders do not respond to dividends beyond the EPS; they consider them unsustainable. For example, if your EPS is $1.50 per share, and your dividend is $2.00 per share, stockholders would ignore anything above $1.50 per share as a driver of stock price. In general dividends have little effect upon stock price. However, Capstone is unlike the real world in one important respect– there are no external investment opportunities. If you cannot use profits to grow the company, idle assets will accumulate. Capstone is designed such that in later rounds your company is likely to become a “cash cow,” spinning off excess cash. How you manage that spin off is an important consideration in the end game, and dividends are an important tool at your disposal.

You cannot issue stock.

You can retire stock. The amount cannot exceed the lesser of either:

- 5% of your outstanding shares, listed on page 2 of last year's Courier; or

- Your total equity listed on page 3 of la st year's Courier.

You are charged a 1.5% brokerage fee to retire stock.

4.4.4 Emergency Loans

Financial transactions are carried on throughout the year directly from your cash account. If you manage your cash position poorly, Capstone will give you an emergency loan to cover the shortfall. The loan comes from a gentleman named Big Al, who arrives at your door with a checkbook and a smile. Big Al gives you a loan exactly equal to the shortfall. You pay one year's worth of current debt interest on the loan and Big Al adds a 7.5% penalty fee on top to make it worth his while.

For example, suppose the current debt interest rate is 10%, and you are short $10,000,000 on December 31. You pay one year's worth of interest on the $10,000,000 ($1,000,000) plus an additional 7.5% or $750,000 penalty. The emergency loan is combined with any other current debt due at the beginning of the next year. You do not need to do anything special to repay it. However, you need to decide what to do with the current debt (pay it off, re- borrow it, etc.). The interest penalty only applies to the year in which the emergency loan is taken, not to future years.

Emergency loans depress stock prices, even when you are profitable. Stockholders take a dim view of your performance when they witness a liquidity crisis. Emergency loans are combined with any current debt from last year. The total amount displays in the Due This Year cell under Current Debt.

Emergency loans are often encountered when last year's sales forecasts were higher than actual sales or when the Finance Department fails to raise funds needed for expenditures like capacity and automation purchases.

4.4.5 Credit Policy

Your company determines the number of days between transactions and payments. For example, your company could give customers 30 days to pay their bills ( accounts receivable) while holding up payment to suppliers for 60 days ( accounts payable).

Shortening A/R (accounts receivable) lag from 30 to 15 days in effect recovers a loan made to customers. Similarly, extending the A/ P (accounts payable) lag from 30 to 45 days extracts a loan from your suppliers.

The accounts receivable lag impacts the customer survey score. If your company offers no credit terms, your product's customer survey score falls to about 65% of maximum. At 30 days, the score is 95%. At 60 days, the score is 98.5%. At 120 days there is no reduction. The longer the lag, the more cash is tied up in receivables.

The accounts payable lag has implications for Production. Suppliers become concerned as the lag grows and they start to withhold material for production. At 30 days, they withhold 1%. At 60 days, they withhold 8%. At 90 days, they withhold 26%. At 120 days, they withhold 63%. At 140 days, they withhold all material. Withholding material creates shortages on the assembly line. As a result, workers stand idle and per-unit labor costs rise.

Login to the Capstone Spreadsheet and click the Decisions menu. Select Finance. Use this area to raise money:

- Current Debt (These are one year loans.)

- Long Term Debt (These are 10 year bonds.)

Stock issues are not permitted.

As resources permit, companies can:

- Retire Stock

- Retire Bonds

- Issue a Dividend

Finance also establishes A/R and A/P policies.

The Rehearsal Tutorial covers Finance decisions. See the website’s Decisions area for complete information about the Rehearsal Tutorial.