Production, Marketing and R&D expenditures must be coordinated with the Finance Department.

Once R&D, Marketing and Production decisions are complete, the finance department will have an accurate idea of the company's fiscal position.

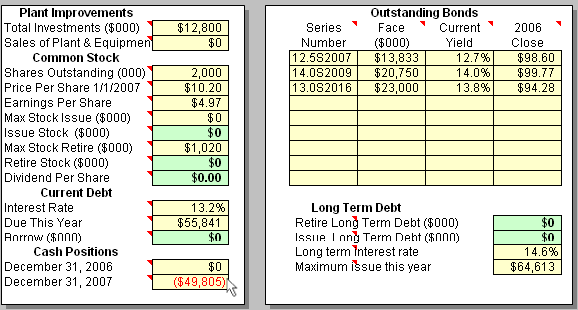

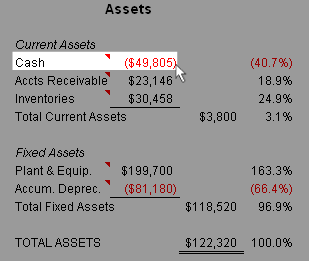

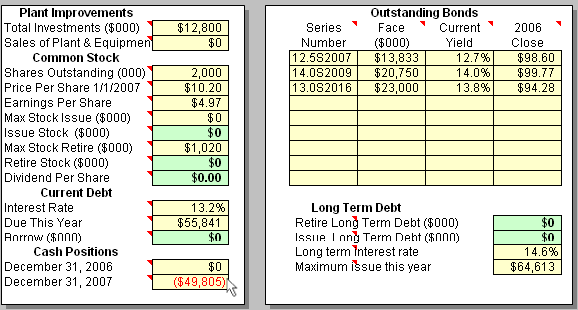

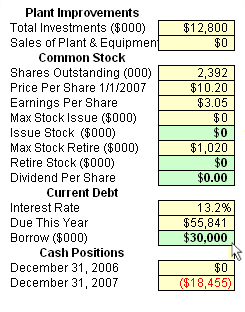

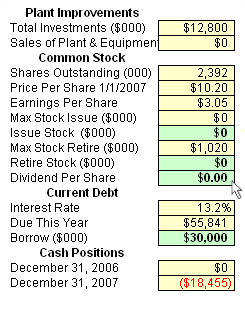

The Cash Position with last year's date is the same as the beginning Cash Position for the current round. The Cash Position as of Dec. 31 of the current round shows the projected position at the end of this year.

The Cash Position is taken from the Proforma Balance Sheet.

A red number in the Cash Position cell indicates a shortfall is expected, and your team will need to turn to the capital markets.

Failing to cover shortfalls means the company will run out of cash. If this happens, the money needed to continue operating will be lent automatically from a lender of last resort named Big Al. Big Al will cover your shortfall with an Emergency Loan which carries an above-market interest rate.

The Finance department can borrow Current Debt by entering a number in the Borrow Current Debt cell. This is a 1-year loan. Current Debt interest rates change from year to year. Interest rates increase as debt loads get bigger

Stock issues are not permitted.

As resources permit, the finance department can retire stock and issue a dividend. This is the amount for the entire year, per share, paid in 4, equal quarterly installments to shareholders.

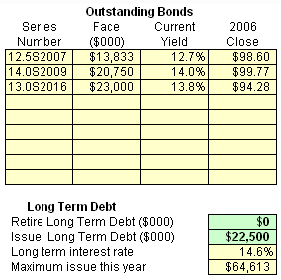

The Finance department can also issue long-term debt with 10-year bonds. Bond interest rates are 1.5% higher than the current round's short-term interest rate. However, as short term interest rates can increase in future years, the department might choose to "lock-in" rates by issuing bonds.

The Finance Department can retire long-term debt. Debt is retired on a first-in, first-out basis, however the Finance Department is not required to take special action as bonds come due.

As they come due, the bond's face value converts to current debt. If they wish, teams can issue additional long-term to debt to cover that amount.